if they wake up 10 years in advance.

absolutely free by investing today in 80 - 180 sq.yards of commercial land.

As a community (group of people) you can make impossible, possible.

You can get 2.4 to 12 crores in 15 years from 80 to 400 trees.

25 cents, 50 cents & 1-Acre plots with 100, 200 and 400 plants.

with the current prices and who can wait for 8-10 years.

Do good anyway.

The best gift any parent can give their child is a debt-free home.

Invest 10-20 lakhs now - Get a Flat worth 1 - 2 cr free

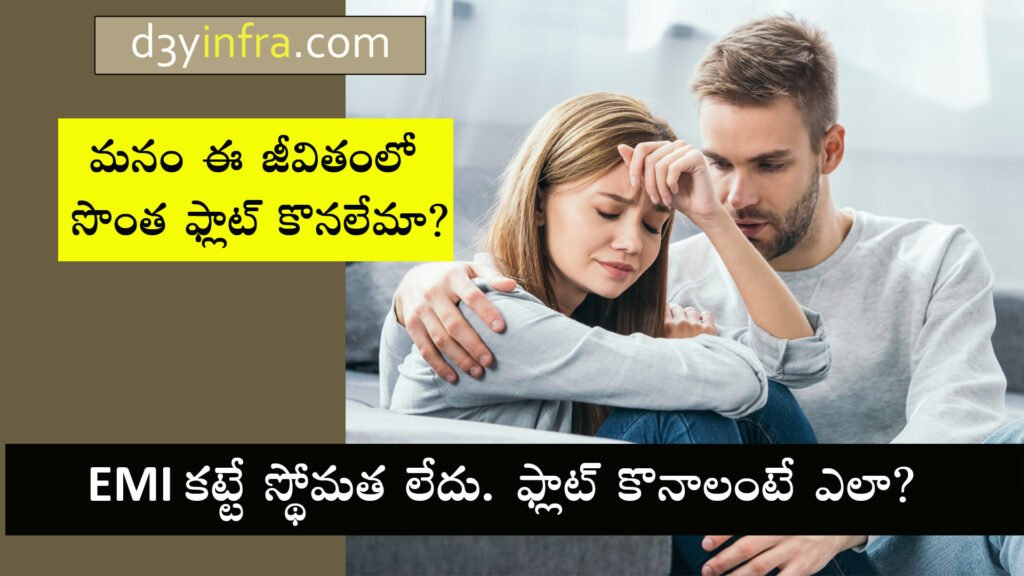

Numerous middle-class parents earning less than one lakh rupees per month face significant challenges in building assets for their children. Their income is often consumed entirely by essential daily expenses such as food, clothing, housing rent, festivals, travel, medical bills, and educational fees. Many parents even resort to loans to cover their children’s marriage expenses. As a result, they are left with little scope to provide fixed assets, which are vital for their children’s long-term financial security. In the event of parental loss, a family home can serve as a source of protection and stability, almost like the continued support of parents themselves.

Therefore, every middle-class parent must be wise and forward-looking in their investment choices to safeguard their children’s future. D3Y Infra offers a unique housing solution that requires only 5–10% of the present flat cost, invested in commercially viable land together with other like-minded individuals. This model enables families to secure a flat valued at ₹2–3 crores within the next 8–10 years at virtually no additional cost, through the landowners’ share model.

We state with confidence that this solution is unparalleled and unmatched. Those who resonate with this vision are warmly invited to visit us and explore how we can help secure their family’s future.

To address this issue, D3Y Infra has devised a solution that can be implemented if a sufficient number of individuals express interest and agree with our proposal. For clarity, we have explained the solution in detail on this webpage. Our comprehensive plan enables middle-class individuals—who may never have imagined owning a flat—to acquire a residence in a gated community valued at over ₹15,000 per square foot by investing just ₹1000 per square foot in commercial land located in high-growth areas. With an investment of ₹10–20 lakhs, one can secure a 1,000–2,000 sq. ft. luxury flat within 6–10 years.

"YESTERDAY'S INACTION IS THE REASON FOR OUR TODAY'S PROBLEMS AND OUR TODAY'S ACTION WILL AVOID TOMORROW'S PROBLEMS."

Distressed middle class.

In the past, individuals found it relatively easy to purchase independent houses and apartments. However, over the last two decades, circumstances have progressively worsened, undermining the aspirations of the middle class. Today, villas are priced between ₹2 and ₹10 crores, while apartments range from ₹50 to ₹200 lakhs. This has made homeownership exceedingly difficult, even for well-educated professionals in white-collar occupations. Those who manage to secure a loan and pay the initial down payment often struggle to allocate a large portion of their monthly income towards EMIs, leading to a hand-to-mouth existence.

The middle class, which contributes significantly to tax revenues, comprises individuals who dedicate their time, energy, and expertise to the organisations they serve. Yet this diligent and essential workforce finds itself neglected by both government bodies and financial institutions. In today’s climate, honest, educated, and principled individuals often feel out of place. They face insurmountable challenges in acquiring a home without resorting to corrupt or unethical means. The absence of assets, lack of personal housing, and crushing monthly EMIs not only erode their self-worth but also strain family relationships, create blame and conflict at home, burden children with stress, disrupt social harmony, worsen health issues, and ultimately threaten the stability of society itself.

It is therefore imperative for like-minded individuals to adopt a forward-thinking approach and envision the next 10–15 years. By forming small communities, setting aside unnecessary fears, applying common sense and logic, and seeking professional guidance from our team at D3Y Infra, they can work towards reshaping their future.

Own house - an unfulfilled dream for the middle class.

The concept of settling down has long been tied to homeownership. The COVID-19 pandemic intensified this desire, as individuals increasingly sought the stability of owning a home. What was once considered a luxury has now become a necessity. The unmatched sense of security and pride in owning a home is undeniable.

However, the feasibility of purchasing a house depends heavily on one’s financial situation. Rising land prices and soaring construction costs are draining the savings of an entire generation over 25 to 30 years. For a middle-income family, homeownership often means spending nearly 50% of monthly income on housing, leading to a hand-to-mouth existence for two to three decades.

At this critical juncture, the middle class must be more strategic than the affluent. By looking 10 to 12 years ahead, and through proactive planning and investment, families can secure valuable assets at only 5–10% of today’s prices.

Rent Scenario

“If you choose to live in a rental property, the immediate cost to the tenant will be approximately ₹15,000–30,000 per month. I recommend that you spend no more than 20% of your family income on rent. Living in a rented apartment does not burden you with the heavy liability of EMI payments. In addition, you always have the freedom to change locations and move to areas that better suit your needs. You can even enjoy living in high-value apartments at comparatively lower rents, making renting a practical and preferable option.

However, if your monthly income is less than ₹1 lakh, or if a home loan EMI exceeds 40% of your monthly income, we do not advise investing in a flat. Instead, we suggest investing in land or a plot that can appreciate 10–15 times in 10–12 years. You can then sell that land and purchase a flat with a 100% down payment — free from EMIs. If you cannot find a safe way to invest in appreciating land, then D3Y Infra is the right choice for you.”

— Anand Reddy, M.D., D3Y Infra

Buying Scenario

When your monthly income exceeds ₹1 lakh, you can consider buying a flat if the EMI amounts to less than 40% of your take-home salary. Flats today range between ₹50–200 lakhs depending on the location, size, amenities, interiors, and other factors. If you are able to save at least 20% of the flat cost over time to pay as margin money, the balance can be financed through a housing loan.

Beyond the sweet satisfaction of owning your own flat, the advantages include freedom from annual rent hikes and the discomfort of dealing with landlords. You also benefit from property value appreciation, typically 5–10% per year. However, it is important to note that with the steep rise in land prices across India, flats are currently overpriced by nearly 100%. Therefore, buyers should not expect significant appreciation for at least 3–5 years.

Solution

Version 1: The Path Followed by 99.9%

Individuals from the middle class, earning less than ₹1 lakh per month and without ancestral property, generally opt for rental housing. They save modestly each month, hoping to use these savings as a down payment when ready to purchase a home. Over a decade, a family may accumulate ₹15–20 lakhs, which becomes the margin money for a flat worth ₹50–100 lakhs. This leads to monthly EMIs of ₹30,000–₹80,000 for the next 25–30 years.

Thus, a family that spends 10 years saving for a down payment ends up paying heavy EMIs for 30 years — effectively devoting 35–40 years to acquire just one asset. By the time they finally become debt-free, they are around 70 years old, with little to no additional savings. Often, such families are forced to sell their hard-earned property to cover medical expenses or their children’s weddings. This is the path followed by over 99.9% of households worldwide, especially in India.

Version 2: Our Suggestion

Instead of this cycle, consider investing a modest sum of ₹8–16 lakhs in commercially viable land, along with a few trusted partners on a cooperative basis. The focus should be on areas where villas are priced at ₹1–2 crores and DTCP plots are already trading above ₹10,000 per square yard.

After a 5–6 year development period, a builder typically constructs about 1.5 lakh sq. ft. on one acre, of which 33% is allocated to the landowners. This share amounts to nearly 50,000 sq. ft., which translates to around 30 flats of 1,650 sq. ft. each.

By forming small groups within their networks, individuals can collectively identify suitable land, invest together, and after 8–10 years, partner with a developer to receive debt-free flats under the landowners’ share — at no additional cost.

Who should utilize our Loan-free Housing Services?

D3Y Infra is the preferred choice for those who wish to secure a debt-free home for their children but find it challenging to save or invest ₹2–3 crores in a quality gated community apartment.

D3Y especially suits software engineers and small business owners whose monthly earnings are below ₹1 lakh.

It caters to individuals who cannot invest ₹50–200 lakhs in a property but can contribute ₹8–16 lakhs today, while continuing to reside in a rental property for the next 8–10 years.

This opportunity is designed for those who recognize that land currently valued at ₹3–4 crores — in areas where DTCP plot prices are around ₹10,000 per sq. yd and villa projects are beginning to emerge — will likely attract apartment developers over the next 5–6 years.

It is also for individuals who understand that builders typically allocate 20–40% of apartments to the landowner, depending on the number of floors (FSI).

Anyone interested in acquiring a flat through this method — whether in Hyderabad or other Indian cities — may consider investing here. Within 8–10 years, they can acquire a flat that could be sold for ₹2–3 crores, reflecting the anticipated market value after a decade. This gain can then be used to purchase a flat elsewhere, enabling full payment without the burden of a bank loan.

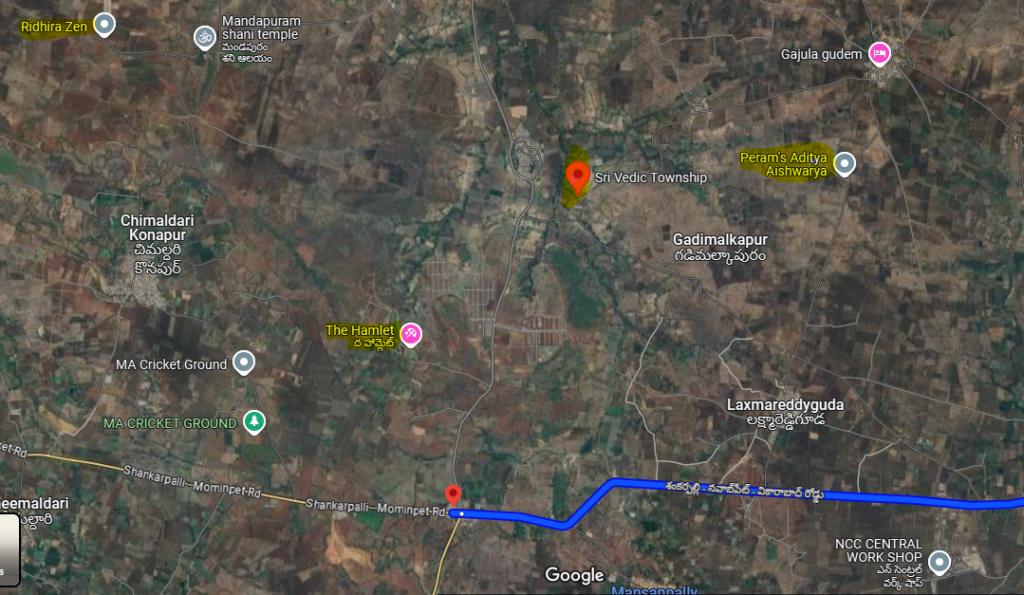

Three areas chosen for Debt-free Housing?

Shankarpally – Mominpet Stretch (28 km stretch): Given its proximity to Kokapet Neopolis SEZ, Shankarpally’s land value is 15 crores. Consequently, we have identified Mehtabkhanguda X Roads as our next target, where the land price is approximately four crore rupees per acre. We anticipate a developer arriving in this region by 2030, with apartment handovers expected in 2034. We are currently awaiting the completion of the RRR project.

No external circumstances can hinder the development of apartments in this locality. The growth is organic, with residential projects having expanded 20 kilometers from Kokapet to Shankarpally over the past eight years. Mehtabkhanguda X Roads is clearly the next logical choice for developers aiming to establish housing infrastructure for employees at Kokapet, Kollur SEZs, and personnel from Mobility Valley in Mominpet. (Location shown as Area-1 in the below map)

Shamshabad – Shadnagar (30 km stretch): The distance from Shamshabad to Shadnagar along the Bangalore Highway is approximately 30 kilometers, while the distance from Muchintal to Shadnagar is around 21 kilometers. This area has experienced significant growth over the past two years. The land prices along this highway range from 5 to 10 crore rupees. Prospective buyers can expect to acquire apartments within a timeframe of 3 to 5 years. We have identified many lands between 10-250-acre parcel of land priced between 2-3 crore rupees per acre between Srisailam and Bangalore Highways, close to green field Highway.

If individuals from across Hyderabad quickly invest 15 lakhs each, they will be able to secure an 1800 square-foot flat in India’s largest gated community free of cost under the landowners’ share. The cost of the flat will be 12,000 rupees per square foot upon possession. (Location shown as Area-2 in the below map)

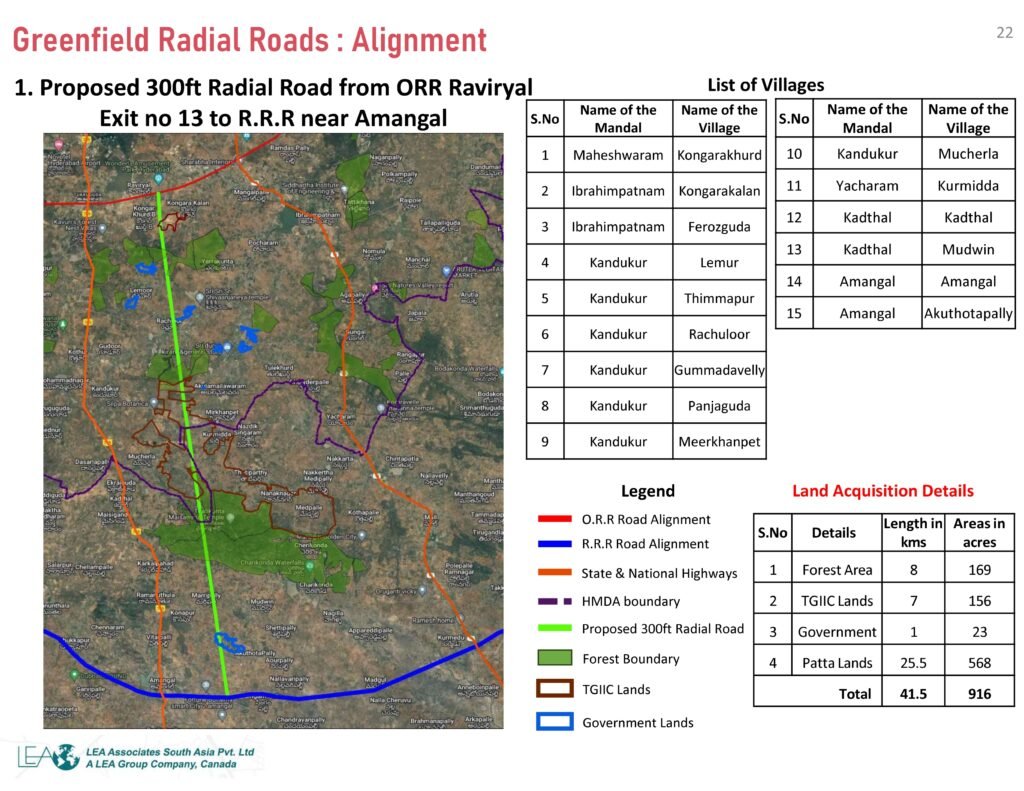

Future City: Raviryal Exit 3 – RRR at Amangal (40km stretch):

The state government is creating a future city of over 30,000 acres to cater to future development needs. This project will house the Young India Skill University and is expected to be a hub for software and life sciences industries, alongside developments like Pharma City and AI City.

Greenfield Road is vital here: We shall see land adjacent to this road, which starts at ORR Raviryal and ends at RRR near Amangal. The price of land here starts at 8cr at Raviryal and 1 crore at Amangal. So, we have chosen the second destination after Mehtabkhanguda X roads. We will select the best lands around the middle of this 40km road priced at about 2-3 crore rupees per acre.

We can get a developer here by 2033, and the apartment can be handed over in 2038. The key factor is how quickly the government completes the 300-foot greenfield highway. It also depends on how best the government creates the future city in this 30,000-acre land bank it has held since Fab City’s time.

Given the above facts and developments, we have decisively concluded the above three destinations for our EMI-free Housing Project. (Location shown as Area-3 in the below map)

We resolve to procure 10–15 acres of land in either of the two identified areas.

The process will move forward strictly based on Expressions of Interest (EOIs). D3Y Infra will not purchase and resell the land on its own. Instead, it will act as a facilitator, collecting EOIs from interested individuals. Once 200 EOIs are received from people willing to invest ₹10–20 lakhs (depending on the flat size they wish to own) and who are prepared to wait 10 years, the land will be acquired. These investors will then become eligible to receive their flats free under the landowners’ quota at the end of the development cycle.

Township Plan for an Understanding (15% Discount considered for example)

- Land: 180 sq. yards *

- Flat area: 1800 sft Flat

- Price: Rs.10,000/- per sqy.

- Cost: Rs.18.0 lakhs.

* With this land, one can get a flat of area 1800sft with 40-60 sq yards of UDS.

- Land: 160 sq. yards *

- Flat area: 1600 sft Flat

- Price: Rs.10,000/- per sqy.

- Cost: Rs.16.0 lakhs.

* With this land, one can get a flat of area 1600sft with 35-55 sq yards of UDS.

- Land: 140 sq. yards *

- Flat area: 1400 sft Flat

- Price: Rs.10,000/- per sqy.

- Cost: Rs.14.0 lakhs.

* With this land, one can get a flat of area 1400sft with 30-50 sq yards of UDS.

- Land: 120 sq. yards *

- Flat area: 1200 sft Flat

- Price: Rs.10,000/- per sqy.

- Cost: Rs.12 lakhs.

* With this land, one can get a flat of area 1800sft with 30-40 sq yards of UDS.

- Land: 100 sq. yards *

- Flat area: 1000 sft Flat

- Price: Rs.10,000/- per sqy.

- Cost: Rs.10 lakhs.

* With this land, one can get a flat of area 1000sft with 25-35 sq yards of UDS.

- Land: 80 sq. yards *

- Flat area: 800 sft Flat

- Price: Rs.10,000/- per sqy.

- Cost: Rs.8 lakhs.

* With this land, one can get a flat of area 800sft with 20-30 sq yards of UDS.

- Gita Bhavan, Star hotel

- Supermarket, Restaurant

- School for human excellence

- Hospital, Clinic, Diagnostics

- Music Academy, Kuchipudi classes

- Chess coaching, karate classes etc

Invest in an Undivided share of Land (UDS) based on your flat requirement.

A6

800 sft flat (Rs.8.0 lakhs)

- Land required (UDS): 80 sq. yards.

- Price: Rs.10,000/- per sqy.

- Discount: 10-20% possible. *

- * Depends on land location.

Payment schedules: - Rs.10,000/- Registration amount.

- 50% upon land finalisation.

- 50% one day before registration.

A5

1000 sft flat (Rs.10 lakhs)

- Land required (UDS): 100 sq. yards.

- Price: Rs.10,000/- per sqy.

- Discount: 10-20% possible. *

- * Depends on land location.

Payment schedules: - Rs.10,000/- Registration amount.

- 50% upon land finalisation.

- 50% one day before registration.

A4

1200 sft flat (Rs.12.0 lakhs)

- Land required (UDS): 120 sq. yards.

- Price: Rs.10,000/- per sqy.

- Discount: 10-20% possible. *

- * Depends on land location.

Payment schedules: - Rs.10,000/- Registration amount.

- 50% upon land finalisation.

- 50% one day before registration.

A3

1400 sft flat (Rs.14.0 lakhs)

- Land required (UDS): 140 sq. yards.

- Price: Rs.10,000/- per sqy.

- Discount: 10-20% possible. *

- * Depends on land location.

Payment schedules: - Rs.10,000/- Registration amount.

- 50% upon land finalisation.

- 50% one day before registration.

A2

1600 sft flat (Rs.16.0 lakhs)

- Land required (UDS): 160 sq. yards.

- Price: Rs.10,000/- per sqy.

- Discount: 10-20% possible. *

- * Depends on land location.

Payment schedules: - Rs.10,000/- Registration amount.

- 50% upon land finalisation.

- 50% one day before registration.

A1

1800 sft flat (Rs.18.0 lakhs)

- Land required (UDS): 180 sq. yards.

- Price: Rs.10,000/- per sqy.

- Discount: 10-20% possible. *

- * Depends on land location.

Payment schedules: - Rs.10,000/- Registration amount.

- 50% upon land finalisation.

- 50% one day before registration.

I am interested. What to do next?

Understanding is the key before getting into action.

- Understand the concept of Debt-free housing thoroughly.

- Please look at the land prices in all three areas mentioned above.

- Use Google Maps to navigate all the three stretches.

- Understand that one must invest 3-4 crores in commercially viable land to attract builders by 2030.

- One may pay Rs.10,000/- as non-refundable registration fees.

- We shall wait until we get 200 people to register their names.

- We suggest you refer 5-10 friends from your circles to speed up the process.

- We shall pick the best land (after all legal checks) in a stretch based on majority interest.

- You must pay 50% of the amount within 1 week from the date we show you the land.

- We shall pay 50% and enter into an agreement for 60 days.

- You are required to pay the remaining amount in 15 days.

- We shall formulate bylaws and register a Housing society with all members as stakeholders and a few members on an ad hoc basis in the executive committee.

- We shall get the land registered directly to the society.

- We shall fence the land and construct a watchman room and two container homes for member visitors.

- We shall get some fruit plantations done on the site for members’ benefit for 5-6 years.

- We shall conduct elections for the EC and hand over the land to the society for peaceful possession.

- We shall continue as Advisory board members to pass on advice at critical stages such as finalising the apartment plan, finalising the developer, allocating flats, etc.

Note: If you want d3yinfra to give the list of all 200 registrations, we shall offer them to the group, should the group decide to search the land on their own. This is not a profit motive model. This is just to enable the middle class man with Rs.10-20 lakh invest and get a 1.0 – 2.0 cr own flat without any Bank loan.